Leading the Way: Male Millennials Shaking Up the Banking Payments Market

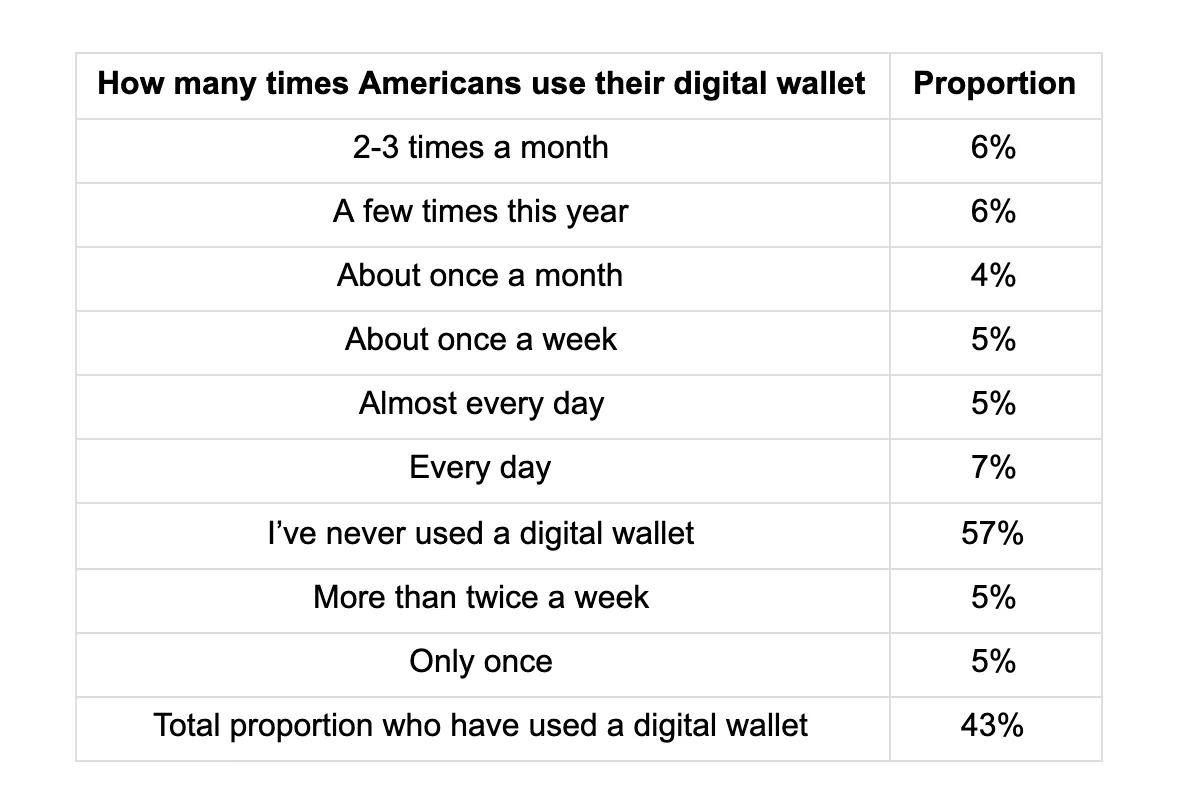

- Over 2 in 5 (43%) of Americans have used a digital wallet to send or receive money this year, such as Venmo, Facebook Messenger, Google Wallet, Apple Passbook, Lemon Wallet, Square Wallet, Chirpify

- That’s an estimated 106.6 million American adults, according to personal finance comparison website finder.com

- Interestingly, more than half (57%) of Americans (60.7 million adults) use their digital wallet more than any other means for transferring money, such as online banking, checks, or ATMs

- 31% use their digital wallets at least once a month

- 7% use their digital wallets every day

A new survey commissioned by personal finance comparison website finder.com and conducted by global research provider Pureprofile has found that young men are leading the way with using digital payment technology to transfer money.

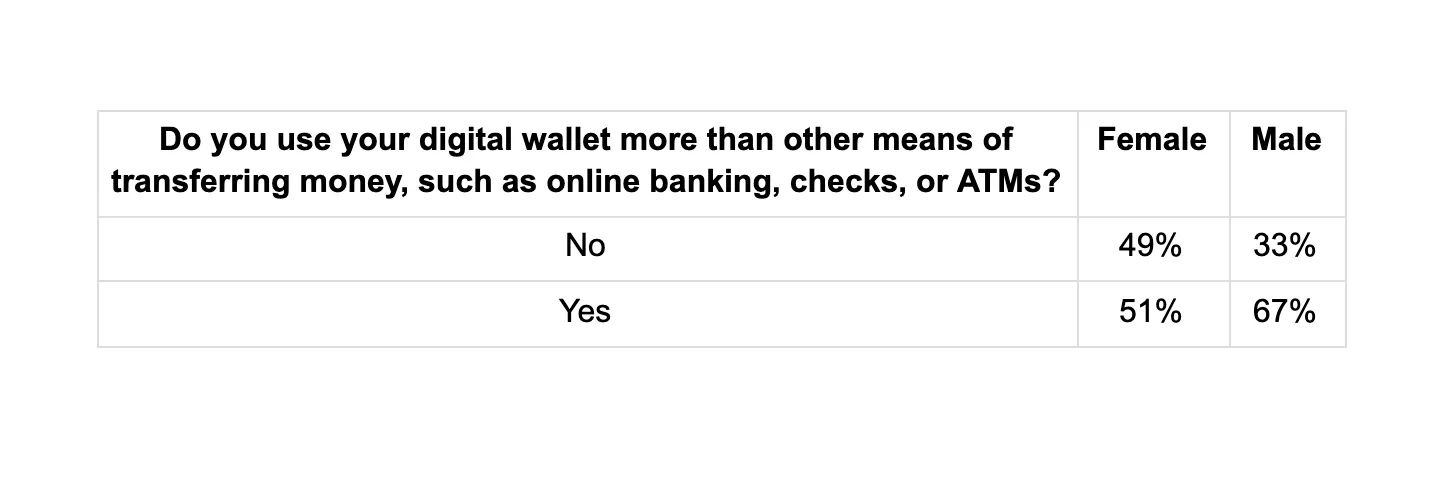

Not only are they using them more than other means of transferring money, such as online banking or checks, but they also tend to spend more money when using their digital wallets.

How many times Americans use their digital wallet

Source: finder.com

Gender breakdown

- Men are more likely to use a digital wallet than women, with over half of men (51%) who have used one in the past year, compared to 39% of women.

- Men are also more frequently using their digital wallets, with 41% saying they use it once a month or more, while 27% of women use theirs at least once a month.

- Men are three times more likely to use their digital wallets every day than women (12% versus 4% respectively).

- Men are more likely to spend up than women when using their digital wallets and more likely to use their digital wallets more than other means of transferring money.

Do you use your digital wallet more than other means of transferring money, such as online banking, checks, or ATMs?

Source: finder.com

Generations

- Millennials (18-34) are the biggest users of digital wallets, with 64% using one in the past year – 50% of which use them regularly (at least once a month).

- 40% of Generation X (35-54) have used a digital wallet in the past year, while 17% of Baby Boomers (55+) have done so.

- Millennials are also more likely to spend more than other generations when using their digital wallets and use it more than other ways to transfer money.

Income, education, employment

- The more you earn, the more likely you will use a digital wallet and spend more money. For example, 60% of those who earn over $100,000 have used a digital wallet in the past year – that’s double the proportion of those who earn half as much.

- Those with tertiary education are more likely to use a digital wallet than those who only completed high school.

- Students are the biggest users of digital wallets, with 63% of students taking on the trend, followed by people who work for wages (57%), self-employed (49%), and homemakers (39%)

- Retirees are the least likely to use a digital wallet, with only 17% that have used one, followed by those unable to work (21%) and those out of work (28%).

Ethnicity

- Asian Americans are the biggest users of digital wallets compared to other ethnicities, with 68% saying they have used them in the past year.

- They are followed by Hispanic or Latino (55%) and African Americans (53%).

Marital status

- The biggest digital wallet users according to marital status are singletons who have never married (53%), followed by married/domestic partnership (42%), and those who have separated (35%).

Dependents

- The more kids you have, the more likely you are to use a digital wallet. This is not surprising as digital wallets can be more cost-effective to transfer money than other means.

Comments by Michelle Hutchison, Money Expert at finder.com:

“Most of us carry our phones with us everywhere we go, and new mobile apps make it easier than ever for it to be the only thing you leave the house with. So we’re not surprised by the popularity of digital wallets, as our study shows over two in five Americans are using digital wallets.

Traditionally, US banks have charged high fees for transferring money from your bank account to other people, but payment apps allow you to sidestep those fees by removing the bank as the middleman. For instance, major banks may charge up to $10 in next-day transfer fees, compared to one digital provider, Venmo, with one business day transfers not incurring any transaction fees.

While banks have been late to join the movement, media reports suggest they are no longer sitting on the sidelines. Many US banks, including Bank of America, Chase, Citi, and Wells Fargo, are planning to launch a payment app called Zelle reportedly next year.

The growth of digital wallet use in America is only a taste of the shake-up they are having on the banking payments market across the world. Research shows America ranks the lowest out of the top 20 countries for consumers preferring to use mobile payments over traditional wallet payments.”

To learn about Prove’s identity solutions and how to accelerate revenue while mitigating fraud, schedule a demo today.

Keep reading

Read the article: How Prove’s Global Fraud Policy Stops Phone-Based Fraud Others Miss

Read the article: How Prove’s Global Fraud Policy Stops Phone-Based Fraud Others MissLearn how Prove’s Global Fraud Policy (GFP) uses an adaptive, always-on engine to detect modern phone-based threats like recycled number fraud and eSIM abuse. Discover how organizations can secure account openings and recoveries without increasing user friction.

Read the article: Prove Supports Safer Internet Day: Championing a Safer, More Trustworthy Digital World

Read the article: Prove Supports Safer Internet Day: Championing a Safer, More Trustworthy Digital WorldProve proudly supports the goals and initiatives behind Safer Internet Day, a worldwide effort that brings together individuals, organizations, educators, governments, and businesses to promote the safe and positive use of digital technology for all, especially young people and vulnerable users.

Read the article: Prove’s State of Identity Report Highlights the New Rules of Digital Trust

Read the article: Prove’s State of Identity Report Highlights the New Rules of Digital TrustProve’s State of Identity Report explores why traditional point-in-time verification is failing and how businesses can transition to a continuous, persistent identity model to reduce fraud and improve user experience.