Prove Survey Reveals More Than Half of U.S. Consumers Would Switch Brands as a Result of Slow Identity Verification

New survey report reveals U.S. consumers are fed up with passwords and identity verification processes; 83% are frustrated with the complexity of creating new online accounts and 60% would abandon account opening if identification verification takes more than 40 seconds

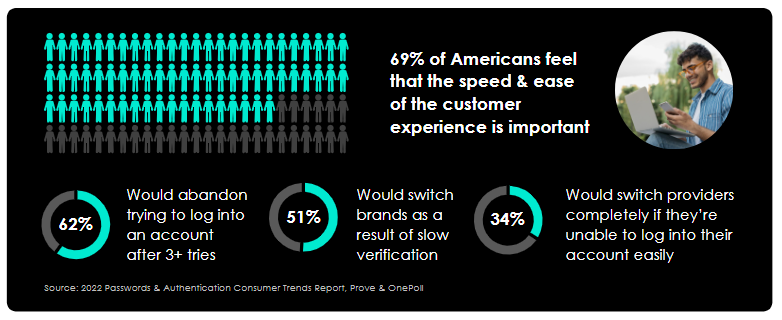

New York, NY, July 27, 2022 - Prove Identity, Inc. (“Prove”), the leader in digital identity, today announced the results of a consumer survey, which revealed that the average American is tired of using multiple passwords to manage online accounts and increasingly intolerant of slow identity verification processes. The study, conducted by OnePoll on behalf of Prove, asked 2,000 Americans about their password habits and found that respondents have an average of four “go-to” passwords — with 31% saying these are just different variations of the same password. 62% of U.S. consumers said they’d abandon trying to log into an account after just three failed password attempts, 51% would switch brands as a result of slow identity verification, and 34% would switch providers completely if they’re unable to log into their account easily. In terms of password security, respondents said they felt they could hack their significant other’s devices in just five attempts. From a customer experience perspective, 64% of the Americans polled said that authenticating their identity through their phone is more convenient than using a password.

Download the full 2022 Passwords & Authentication Consumer Trends Report here.

“The internet wasn't built with security in mind and so as consumers, we all experience how tedious passwords and two-factor security can be. Screw up your password entry a few times, and now you are locked out and spending 20 minutes with a call center agent to fix things. It's just a broken model held together with duct tape,” said Rodger Desai, Chief Executive Officer and Co-Founder of Prove. “Every decade, we see the Fortune 500 go through a major reshuffling. Businesses that modernize their digital channels by removing the friction caused by antiquated security, and are easy to work with, will take all the market share in the next reshuffling. Consumers flock to businesses that respect their time and keep them secure without hassle. In our view, the winners in the digital economy will be those that kill the password, and Prove’s authentication will be a key tool in making digital journeys easy, secure, and private.”

Consequently, more than one in five (22%) have been the victim of identity fraud and another 36% know someone who has. Finally, three-quarters of survey participants avoid saving their banking or credit card information on online accounts and profiles.

Additional survey findings include:

- 45% believe it should take less than 30 seconds to create a new online account

- 69% of Americans feel that the speed and ease of the customer experience when signing up for new financial products such as a credit card, bank account, or cryptocurrency account is somewhat or very important

- 44% said the ability to open or use an account from their mobile phone or device was an important factor when completing a new online account application

- The most preferred way of authenticating identity in the Metaverse was through phone signals (38%) vs. passwords (30%), SMS text codes (13%), and biometric authentication (9%).

“As we have all seen, the security that online businesses use is overly tedious and yet, not very secure,” continued Desai. “The bottom line for consumers? Complicated doesn’t mean secure. The solution is actually sitting in the pocket of most adults – their cell phones. Your phone is by far the most secure, accurate, and frictionless way to prove identity – and our survey demonstrates that consumers would prefer the convenience of the phone in their pocket.”

Visit prove.com to download the full survey report.

About Prove Identity, Inc. (“Prove”)

As the world moves to a mobile-first economy, businesses need to modernize how they acquire, engage with and enable consumers. Prove’s phone-centric identity tokenization and passive cryptographic authentication solutions reduce friction, enhance security and privacy across all digital channels, and accelerate revenues while reducing operating expenses and fraud losses. Over 1,000 enterprise customers use Prove’s platform to process 20 billion customer requests annually across industries, including banking, lending, healthcare, gaming, crypto, e-commerce, marketplaces, and payments. For the latest updates from Prove, follow us on LinkedIn.

PR Contact:

Keep reading

Read the article: Beyond the OTP: Why SMS-Based 2FA Is Failing and What Comes Next

Read the article: Beyond the OTP: Why SMS-Based 2FA Is Failing and What Comes NextExplore the classic conflict between security measures and user friction.

Read the article: Anatomy of an Account Takeover Attack: Analysis and Response Plan

Read the article: Anatomy of an Account Takeover Attack: Analysis and Response PlanLearn practical strategies for handling identity verification API errors or no-match responses. Explore fallback methods and clear communication tactics to ensure a smooth, user-friendly experience.

Read the article: Prove Global Fraud Policy℠: A New, Adaptive Standard for Digital Identity

Read the article: Prove Global Fraud Policy℠: A New, Adaptive Standard for Digital IdentityIntroducing the Global Fraud Policy (GFP), Prove’s new unified, adaptive fraud-defense engine that replaces fragmented, custom rules with a single, comprehensive policy that automatically updates as new threats emerge. This forward-looking framework helps businesses anticipate and respond to evolving threats like GenAI deepfakes, synthetic identities, and eSIM bots, protecting customers at scale.